After connecting with these firms on Dexair Prime, people go through an exhaustive learning process in their preferred area of investment topics and are awarded certificates. People planning to take investment-related careers may start after their training period.

Connecting with investment education companies through Dexair Prime is easy. To start, people should fill out the registration form for free on Dexair Prime with their names, email addresses, and phone numbers. Investment education firms’ representatives will contact anyone who registers for more information.

As people connect with investment education firms through Dexair Prime, they develop long-term financial management, critical thinking, problem-solving, and risk analysis skills applicable to their lives, careers, jobs, and finances. Get these skills from investment teaching classes by registering on Dexair Prime.

Through investment education, people may begin to realize their financial abilities and other related ones.

Investment education does not only give new skills; it helps awaken existing but untapped abilities. Sign up on Dexair Prime to learn to approach finance objectively.

Investment has diverse areas for people to explore. People can choose which area of investment to specialize in.

Specializing helps learners acquire knowledge that suits their personal or business needs. Register for free on Dexair Prime to explore investment courses.

Dexair Prime does not teach investment, yet shares bite-sized investment content. Learners should read the content to prepare for their prospective classes.

To get investment education, people must register on Dexair Prime. Registration is done by clicking the sign-up button and submitting names, email addresses, and phone numbers.

After registering, Dexair Prime connects people immediately with investment education firms. The firms contact people via phone to onboard them for their classes.

Teachers in these firms conduct research, design curriculums, assign quizzes, and offer correction and feedback on learners’ work. The firms also design study budgets and offer insight to learners on their choice of study. Register on Dexair Prime to connect with an investment education firm.

Investing means putting money into a tangible or intangible asset to try for gains. Tangible assets include land, machinery, vehicles, and buildings, while intangible assets are copyrights, franchises, trademarks, and patents. While tangible assets’ value can depreciate, intangible assets’ value may appreciate or remain stable. Dexair Prime discusses below people’s processes of selling assets and setting up businesses:

People search their portfolios for assets mature enough for sale and determine the asset’s market value. Due to value fluctuations, a seller may wait till the value reaches a high enough level. The seller also calculates costs like commissions or fees required before selling an asset, as it will reduce their returns.

A seller values assets using the base stock, market value, cost, or standard cost method before searching for a buyer. Sellers can begin by checking their network, using business directories that list likely buyers, or employing the services of business brokers. Sign up on Dexair Prime to learn more.

Negotiation

Negotiation involves stating the asset for sale and the amount. Sellers aim to sell at the offer they find attractive. Learn more about asset sale negotiation by registering on Dexair Prime.

Preparing Necessary Documents

At this stage, the seller prepares key legal and financial documents for starting their business and operating smoothly. Use Dexair Prime and learn more.

Closing

This is when the seller closes the asset sale deal and officially wraps up.

After going through the previous steps, the actual sale occurs here through private sales, online marketplaces, or auctions. The buyer and seller reach an agreement, demanding the seller to draw a sales contract showing the asset sold, price, and sales conditions. To get more information, sign up on Dexair Prime.

Once the contract is signed, the seller transfers ownership to the buyer, and they begin their business operations. To start, the business obtains its permit or license and opens a bank account. Sellers always try never to sell below an asset’s worth just to start a business. Register on Dexair Prime to learn more from investment tutors.

The cost method values assets by basing their value on the historical price for which they were purchased. The market-value method values an asset based on its market/projected price when sold. If similar assets are unavailable in the open market, the asset’s value is determined using the realizable or replacement value method. The base stock method requires that a company keeps stocks whose value is assessed based on a base stock value. The standard cost method uses expected costs (based on a company’s experience) to determine an asset’s value.

Intangible asset valuation are income, cost, and market value methods. The income method values an asset based on the cash flow it may bring into a business over time. The cost method measures an asset’s value through the cost of replacing or rebuilding an asset. The market-based approach values an intangible asset by imitating other companies’ payment for a similar asset. Sign up on Dexair Prime to learn about stock valuation methods.

This entity is an intermediary between an investor and a buyer or securities exchange. Fundamental functions of brokerages include conducting due diligence, screening asset buyers, developing marketing strategies, facilitating negotiations, and closing sales. Brokers also execute trades on the financial market, store and protect customer data, and provide information about trading platforms.

Types of brokers are online, discount, and full-service brokers. Online brokers use digital channels to interact with customers, reducing commissions and increasing service speed. Discount brokers perform buy and sell orders at minimal commission rates, while full-service brokers offer diverse professional services. Dexair Prime explains a few brokerage specializations below:

These represent parties needing insurance solutions for transferring financial risks. The brokerage also discovers a buyer’s business operations, evaluates their needs, understands their risk tolerance, and provides options that match their needs. Register on Dexair Prime to discover more about insurance brokerage.

These help people find lenders that match their credit needs. The brokerage oversees the credit institution selection, financing, credit issuing, and repayment processes. When employing the services of credit brokerages, lenders watch out for previous reviews and transparency in fees. To learn more about credit brokerages, register on Dexair Prime.

These work independently to search for and connect real estate buyers and sellers. Some real estate properties include offices, warehouses, and residences. This brokerage charges a percentage of every real estate transaction handled. Sign up on Dexair Prime to learn more.

They connect business owners/managers, equipment manufacturers/retailers, and lending companies. In this case, business owners/managers have equipment or facilities to lease to other businesses, equipment retailers or manufacturers have equipment to sell, and lending companies are ready to purchase and lease equipment to business owners. Discover more about this process by signing up on Dexair Prime.

Equity investors take high risks, may receive high returns as capital gains and dividends, and have ownership/voting rights. A business may recapitalize by optimizing its capital structure through a debt and equity mixture. Recapitalization methods include issuing debt and repurchasing equity, issuing debt and paying a large dividend to equity investors, and issuing equity and repaying debt. Register on Dexair Prime to learn more.

Activities that govern corporate finance include investments and capital budgeting, capital financing, and dividends and return of capital. Investments and capital budgeting involve planning how to place a company’s long-term capital assets for the highest risk-adjusted returns.

Capital financing decides how to finance a company’s capital assets through its debt and equity. Dividends and returns of capital involve deciding if to retain a business’ excess earnings for future investments and operational needs or to distribute it to shareholders as share buybacks or dividends. Connect with investment education companies on Dexair Prime to know more.

In business or finance, an appraisal determines an asset’s value based on its selling price in the market. Professionals appraise assets to facilitate asset transactions, settle disputes, and secure financing. Appraisal types are qualified, equipment, and real estate appraisals. Register on Dexair Prime and connect with investment education firms to learn more about asset appraisal and how it differs from asset valuation.

This describes the expected compound annual rate of a return on an investment. Register on Dexair Prime to learn more.

A XIRR calculates returns on investments for companies in cases of multiple transactions at different times. To learn more, sign up on Dexair Prime.

An investor allocates capital to assets for possible gains. Get detailed information from investment teachers when registered on Dexair Prime.

This investment strategy aims to beat risks by taking an opposite position in a related asset. Get more details by signing up on Dexair Prime.

These are pooled from different investors to buy a diversified portfolio. Register on Dexair Prime to learn how mutual funds work.

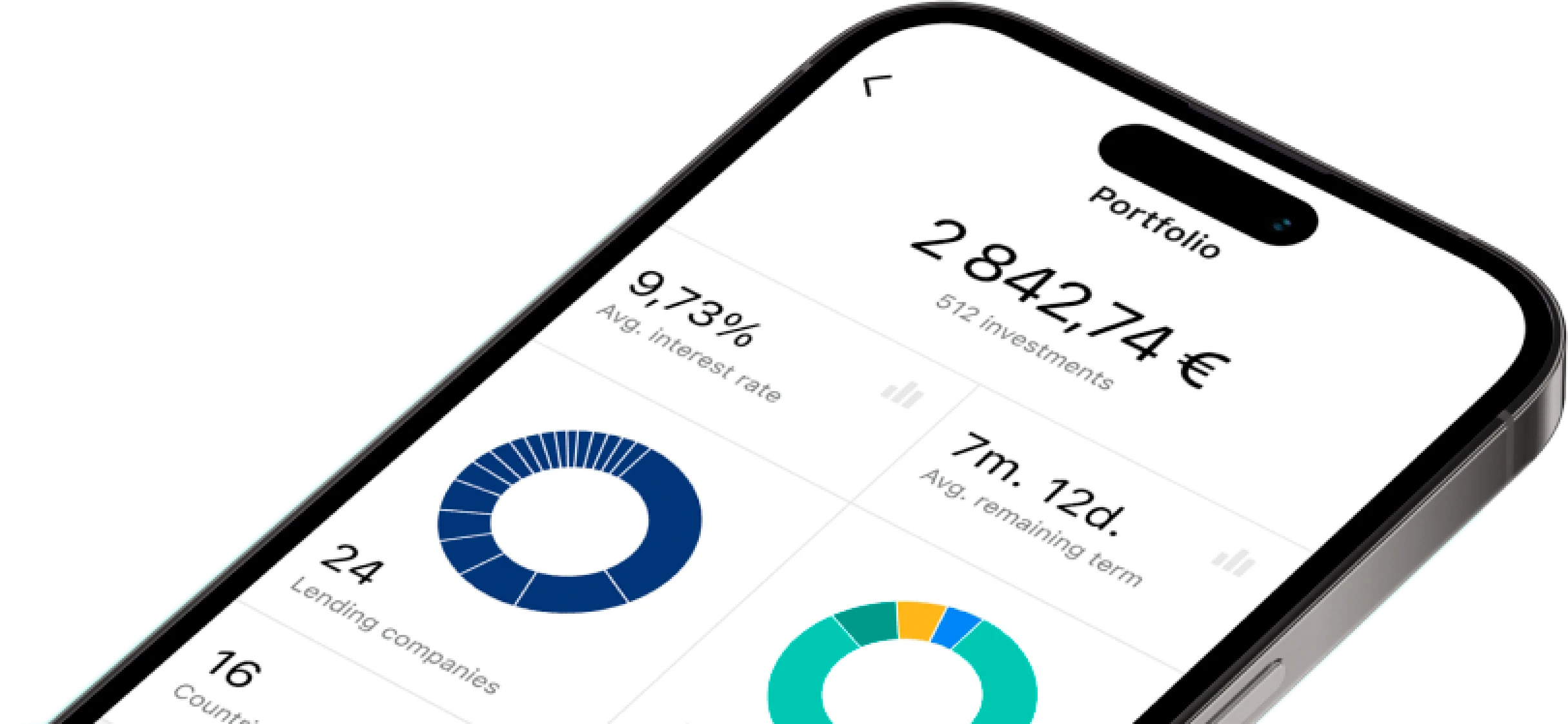

It is a collection of assets or securities owned by a single investor. Discover how investors create portfolios by registering on Dexair Prime.

| 🤖 Registration Cost | Free of Charge |

| 💰 Financial Charges | No Additional Charges |

| 📋 Registration | Quick and Straightforward Process |

| 📊 Education Opportunities | Crypto, Mutual Funds, Forex, Stocks |

| 🌎 Supported Countries | Available Worldwide, Excluding the USA |